Insights: Article

Article

Mastering Inventory Management: The Key to Manufacturing Success

Inventory management is a critical component that can make or break a company's success when it comes to manufacturing. Effective inventory management ensures that you have the right materials, in the right quantities, at the right time, and in the right place. By mastering this essential aspect of your operations, you can reduce costs, improve efficiency, and ultimately, boost your bottom line.

Article

The Hidden Cost of Doing Business in Multiple States: A Tax Perspective

As a business owner, expanding your operations into new states can be an exciting prospect. However, with growth comes new responsibilities, including the obligation to file taxes in those states. Unfortunately, not all businesses are aware of the potential pitfalls and risks associated with state and local taxes, leaving them vulnerable to scams and costly mistakes.

Jun 12, 2024

Article

Cybersecurity Essentials for Protecting Your Employee Benefit Plans

Employee Benefit Plans (EBPs) play a crucial role in securing the future of millions of workers. However, with the rising tide of cybersecurity threats, these plans are increasingly vulnerable to attacks that could compromise sensitive data and assets. Understanding the importance of cybersecurity in relation to EBPs is vital for Plan Sponsors, Recordkeepers, and Participants alike.

Article

Metrics That Matter: Assessing Your Not-for-Profit’s Fundraising Health

Effective fundraising is critical for many not-for-profit organizations to fully fund their programs and execute the mission. But how do you know if your fundraising efforts are effective, and you are using the best strategy? Analyzing key fundraising metrics can provide valuable insights to help you optimize your approach and get the most out of your fundraising investments.

May 27, 2024

Article

Building Your Budget: Moving Forward & Putting It All Together

Welcome to the second installment of our Comprehensive Budget Series. Previously we explored the why, when, and how of budgeting. In this article, we’ll focus on the practical steps involved in building a budget that aligns with your goals and supports your organization’s financial health. We’ll discuss strategies for allocating resources, making informed decisions, and addressing challenges that may arise during the budgeting process. No matter what type and size business you’re managing, the principles and techniques covered here will help you create a budget that sets you on a path to success.

May 13, 2024

Article

Harnessing Data for Business Success: How Data Warehousing and Power BI Drive Growth

This article explores how integrating a robust data warehouse with Microsoft’s Power BI can streamline your data analysis, enhance business intelligence, and drive strategic decisions that lead to sustained business growth. Join us as we delve into the mechanics of data warehousing, the benefits of Power BI, and how their combined effort can revolutionize your approach to data management.

Article

Become a Profitable Powerhouse: Financial Strategies for Manufacturing

In manufacturing, navigating financial complexities to support profitability and growth can be challenging. But with the right strategies, you can enhance your bottom line and set your business up for long-term success. Here's how:

Article

How AI Can Transform Operations in Not-for-Profit Organizations

Efficiency and efficacy are necessities for survival and growth in not-for-profit organizations. As technology advances, artificial intelligence (AI) emerges as a powerful ally in enhancing these aspects. Not-for-profits, often strapped for resources, stand to gain significantly from integrating AI into their workflows.

Article

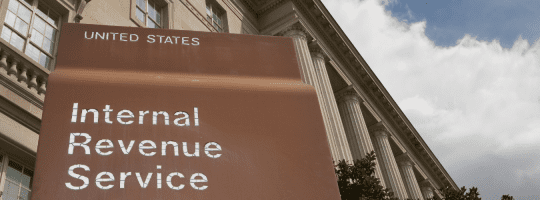

Navigating IRS 1099 TIN Mismatch Letters: What You Need to Know

The IRS has recently issued a series of 1099 TIN mismatch letters, also known as CP2100 and CP2100A notices for 2022 and 2023, indicating a ramp-up in enforcement and penalties related to 1099 filings. These notices can lead to significant compliance obligations, so understanding what they mean and how to respond is crucial for maintaining compliance and avoiding penalties.

Article

The GASB Approves Statement No. 103 on the Financial Reporting Model

In its April 2024 meeting, the Governmental Accounting Standards Board (GASB) approved the issuance of Statement No. 103 regarding changes to the financial reporting model. The new standard will revise and build upon the requirements in GASB Statement No. 34. The full standard will ultimately be published on the GASB’s website. Key changes in the … Continued